In today’s fast-paced world, passive income has become a popular subject of discussion. People aspire to generate income with minimal effort, allowing it to flow consistently over time. Fortunately, the digital era has opened numerous opportunities to establish passive income streams. Consequently, earning money online has never been more accessible and straightforward.

Peer-to-Peer Lending

P2P lending, or peer-to-peer lending, has emerged as a digital-age alternative for investing and generating passive income. These lending platforms directly connect lenders with borrowers, bypassing the need for traditional financial intermediaries. By lending money to individuals, small businesses, or real estate ventures, you, as a lender, can earn passive income. This market boasts a significant size that is expected to expand further.

As online marketplaces, P2P lending platforms facilitate borrowing and lending. Borrowers submit loan applications, providing details such as the loan amount, purpose, and repayment terms. The platform evaluates the creditworthiness of borrowers and assigns an interest rate based on their risk profile. As a lender, you can peruse available loan listings and select investments that match your risk tolerance and investment objectives.

One of the key benefits of P2P lending is the opportunity to diversify your investments. Rather than committing a large sum to a single loan, you can distribute your investment across multiple loans, mitigating the risk of potential defaults. P2P lending platforms typically offer a range of loan options with varying interest rates, terms, and risk levels, enabling you to construct a well-rounded portfolio.

Airbnb

Passive income has seen a surge in popularity through investments in rental properties and leveraging platforms like Airbnb. The emergence of the sharing economy, coupled with the growing desire for distinctive and customized travel encounters, has opened up fresh avenues for property owners.

Airbnb has pioneered a paradigm shift in travel by providing property owners with a platform to list their homes, apartments, or spare rooms for short-term rentals. This adaptable model empowers you to generate income by hosting guests on a nightly or weekly basis.

Short-term rentals often command higher rates than their long-term counterparts, particularly in sought-after tourist destinations or during peak seasons. By offering a unique and well-maintained space, you can allure travelers searching for authentic local experiences while simultaneously generating passive income.

Leveraging Airbnb as a rental platform yields multiple benefits. Firstly, it enables property owners to earn higher rental income than traditional long-term leases. Moreover, hosts enjoy more autonomy over their properties, allowing them to set availability and pricing, and establish house rules.

Passive Income Apps

Lately, there has been a surge in the popularity of applications that enable you to monetize a specific resource from your devices. Typically, these apps leverage your unused internet bandwidth and compensate you financially for its utilization.

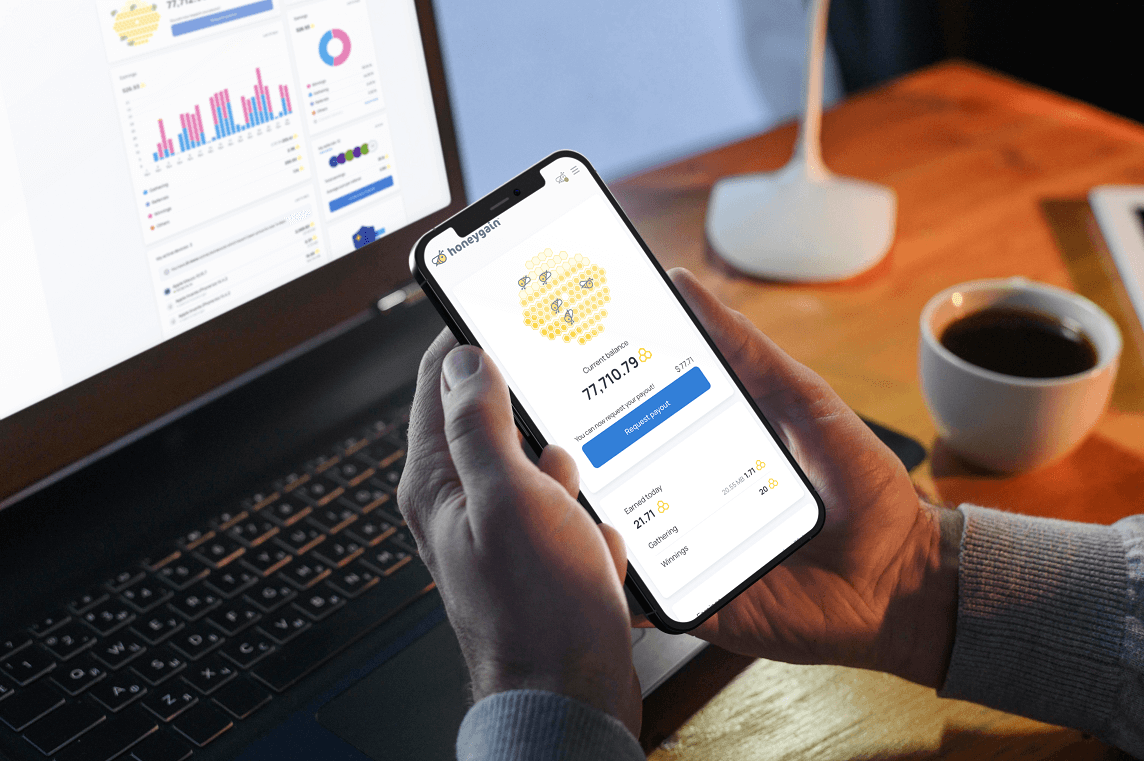

Take, for instance, the Honeygain application—an earnings solution that precisely fits this description. By running the app on your devices, it shares your untapped internet bandwidth with its network, rewarding you with credits in return. In this system, each 10 MB of shared traffic earns you 3 credits, with a conversion rate of 1000 credits equating to $1. The entire process operates automatically, and once you accumulate a minimum of $20 in credits, you can request a payment to your PayPal account or crypto wallet.

It’s worth noting that other similar apps exist, each with its own unique reward and payment systems. Conducting further research becomes essential to discover the app that aligns best with your preferences. Nonetheless, the common thread among these apps remains consistent—offering a truly passive income stream that requires no active input from the user.

Digital Products

The advent of the digital era has opened up a myriad of opportunities for creators to capitalize on their skills and knowledge, generating passive income through the creation and sale of digital products. This contemporary and scalable approach offers a profitable means of livelihood.

One prominent avenue for passive income in digital products is the creation of online courses. With the soaring popularity of online learning, individuals are willing to invest in well-structured and valuable courses. If you possess extensive expertise or skills in a specific field, consider developing an online course.

Alternatively, if you possess expertise in a particular domain or harbor a passion for writing but prefer not to create a course, consider crafting and selling e-books. The demand for e-books spanning various genres, including self-help guides, cookbooks, novels, and technical manuals, remains consistently high. Platforms like Amazon Kindle Direct Publishing (KDP) empower you to self-publish and distribute your e-books globally, allowing you to earn royalties for each sale.

To summarize, passive income has evolved beyond conventional methods and embraced the digital realm. Numerous applications now enable effortless earning of passive income with a simple tap or click on your smartphone or desktop device. Do not wait anymore, and start right now!